Before a developer is able to build a project they have to bid for a piece of land through the Government Land Sale (GLS) programme which happens twice a year. And a huge determining factor of how much will the project cause predominantly attributes to how much the developer is able to buy the land parcel for.

Let’s take a look to see how we can use GLS to determine if a project is safe to enter. For this example, we will be using The Botany at Dairy Farm as a case study.

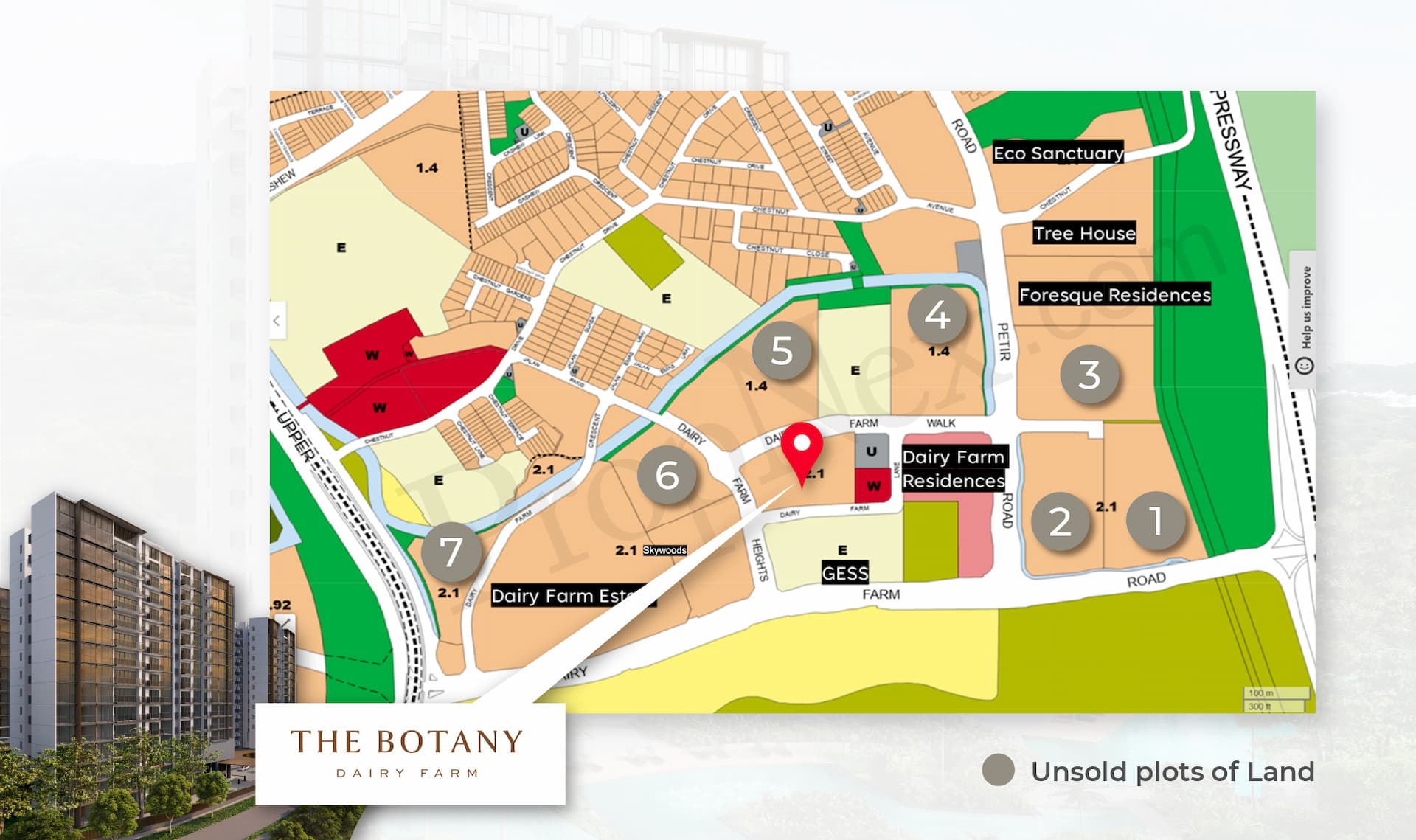

Looking at the Master Plan in the area surrounding The Botany, we can easily see that there are seven plots of land all around that have yet to be sold. How that does affect the future prices at The Botany? As land costs continue to drive upward, it will likely help to elevate prices there – first-mover advantage.

Let’s take a look at similar examples of first-mover advantage

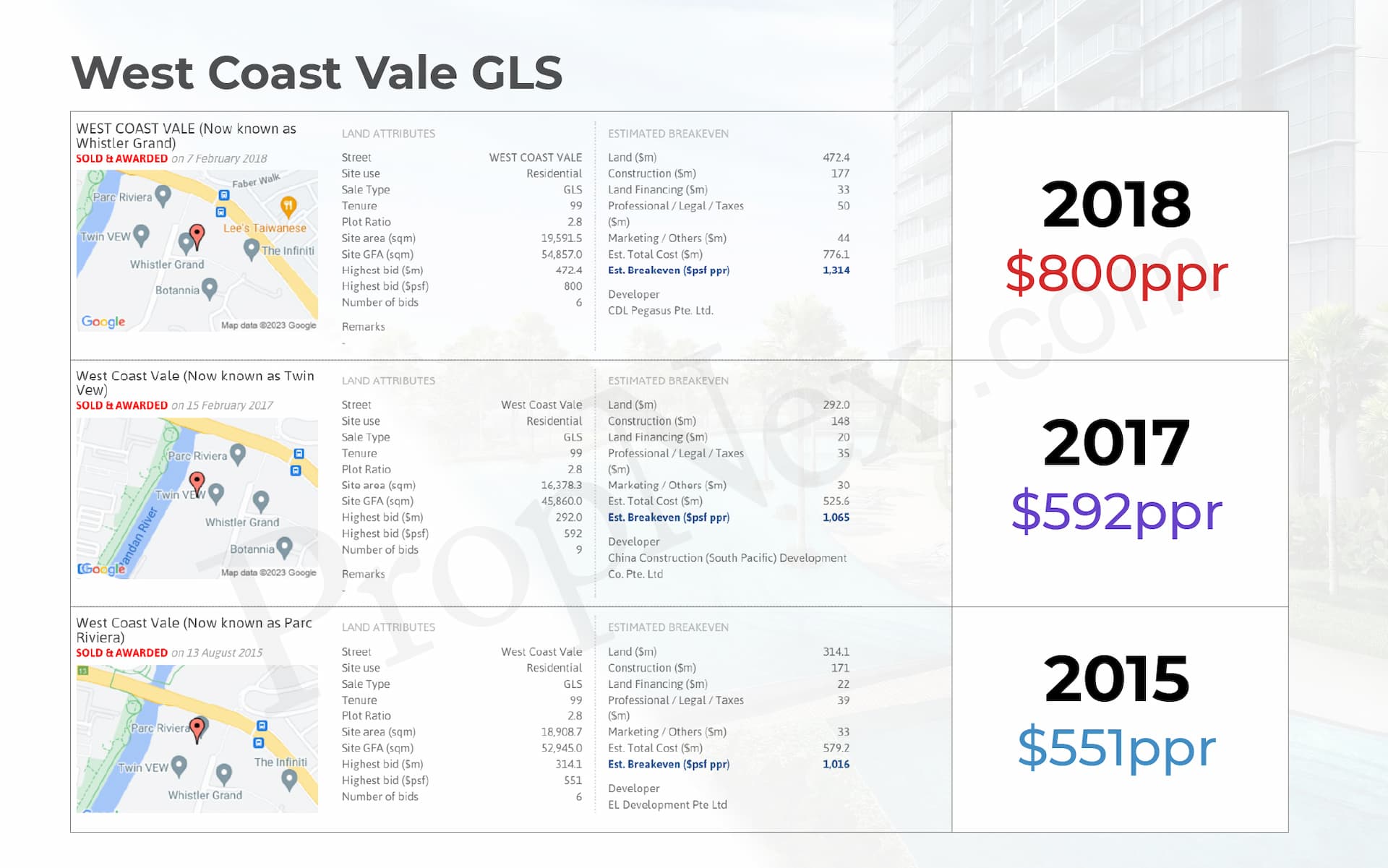

For the West Coast Vale GLS, we can see evidence of a rise in the price of land cost through the years.

How has this helped residents of Parc Riviera?

As you can see, because of the rise in land costs and the later project launches, it has helped to bump up the prices of Parc Riviera. Some homeowners even made close to $400,000 in profit!

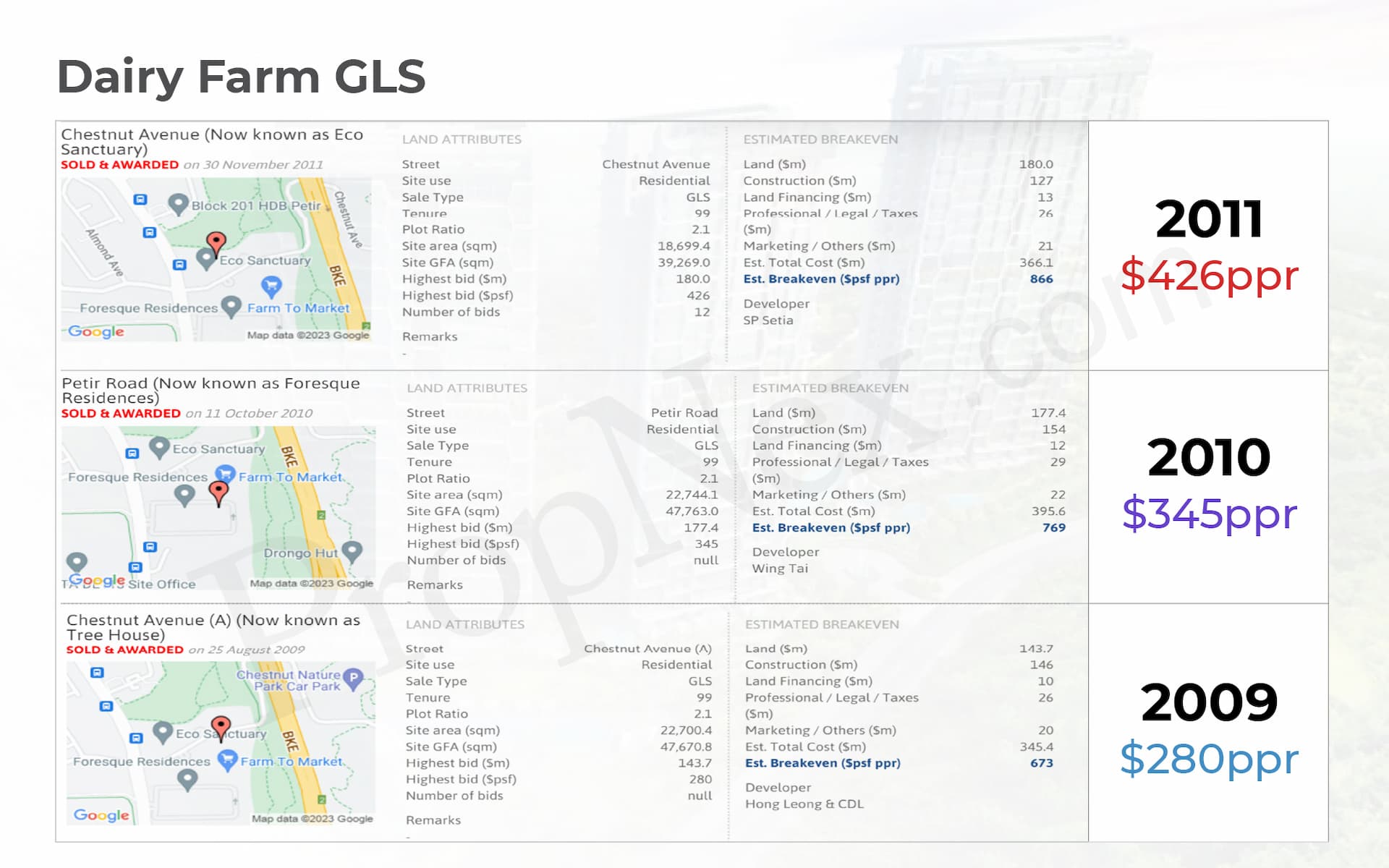

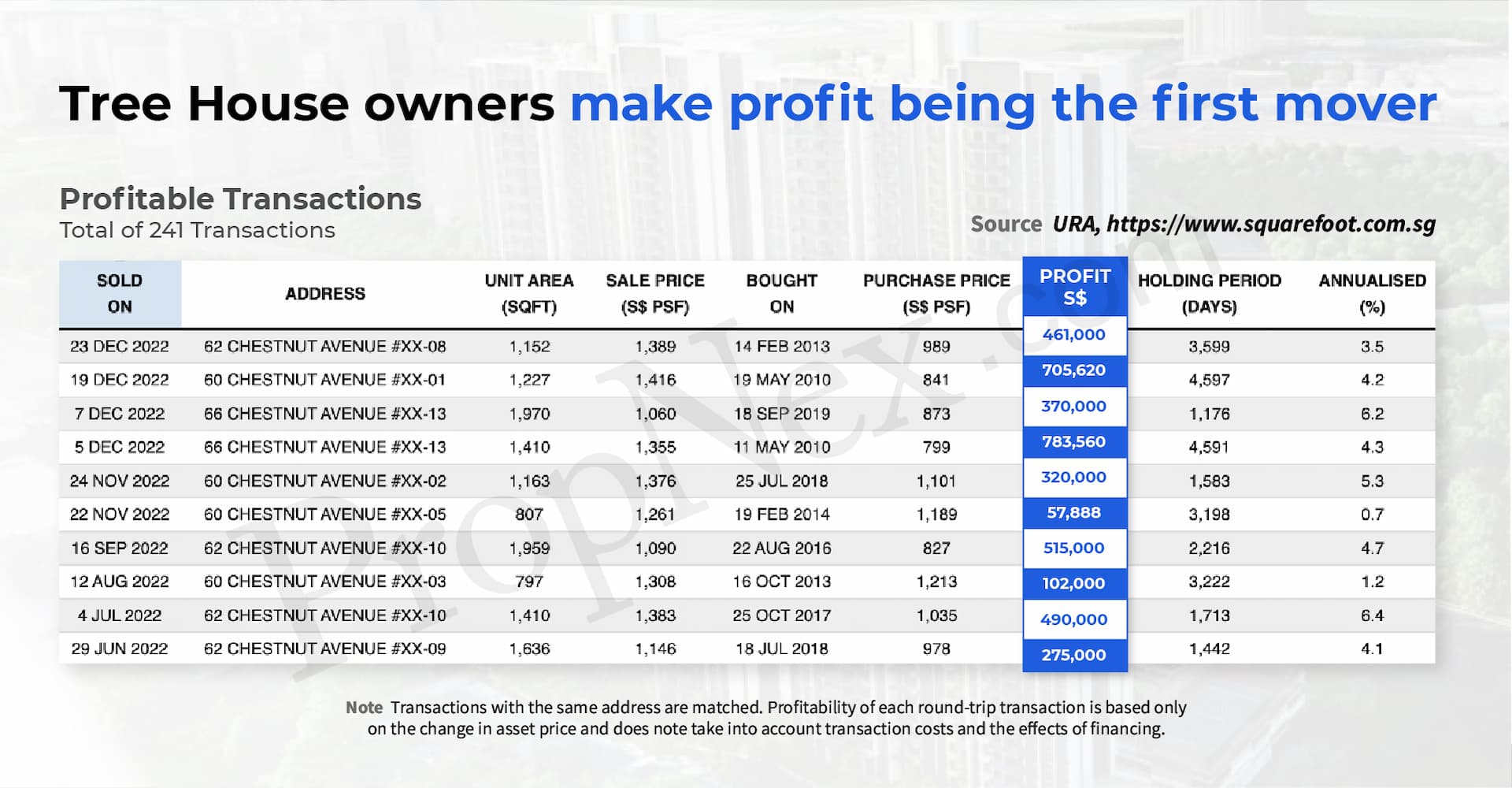

Let’s take a look at another example closer to The Botany at Dairy Farm.

Similar to the West Coast GLS, we can also see the rise in land cost for the different developments. How has that helped first-movers like the ones who bought Tree House?

We can see people enjoying huge profits, with ones as staggering as $780,000!

Hence, taking a step back and looking at The Botany at Dairy Farm, is there a potential upside from the seven plots of land that have yet to be sold? Quite evidently yes. There is a first-mover advantage to be gained as its land cost is the lowest among upcoming new launches.