HDB resale prices rose 1.5% in Q1 2025 – the 20th straight quarter of growth – hitting a new RPI high of 200.9. While transactions dipped 7.7% YoY to 6,392 units amid cooling measures and BTO competition, million-dollar flats hit a record 348 (5.5% of sales). With BTO rejections and returning buyers, PropNex expects stronger H2 demand and 5-7% full-year price growth.

Price Movement

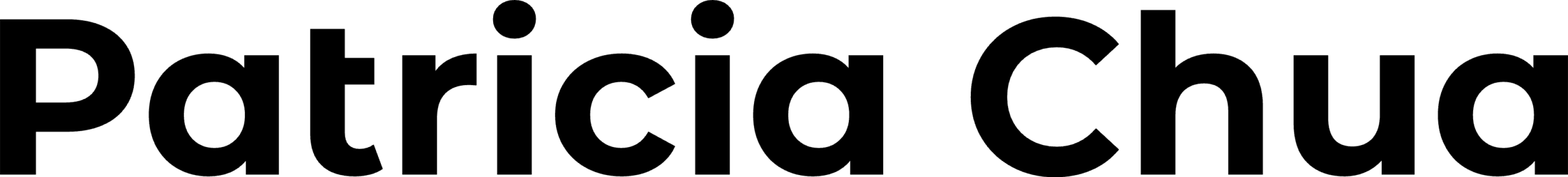

- HDB resale prices rose 1.5% QOQ, slowing from 2.6% QOQ in Q4 2024.

- This marks the 20th consecutive quarter of HDB price increases.

- Resale Price Index reached a new high at 200.9.

Transaction Volume

- 6,392 flats resold (↓7.7% YOY from 6,928 units in Q1 2024).

- Contributing factors:

- Cooling measures still working through the market.

- Feb 2025 launch of 10,622 new BTO and SBF flats diverted some demand.

Million-Dollar Flats

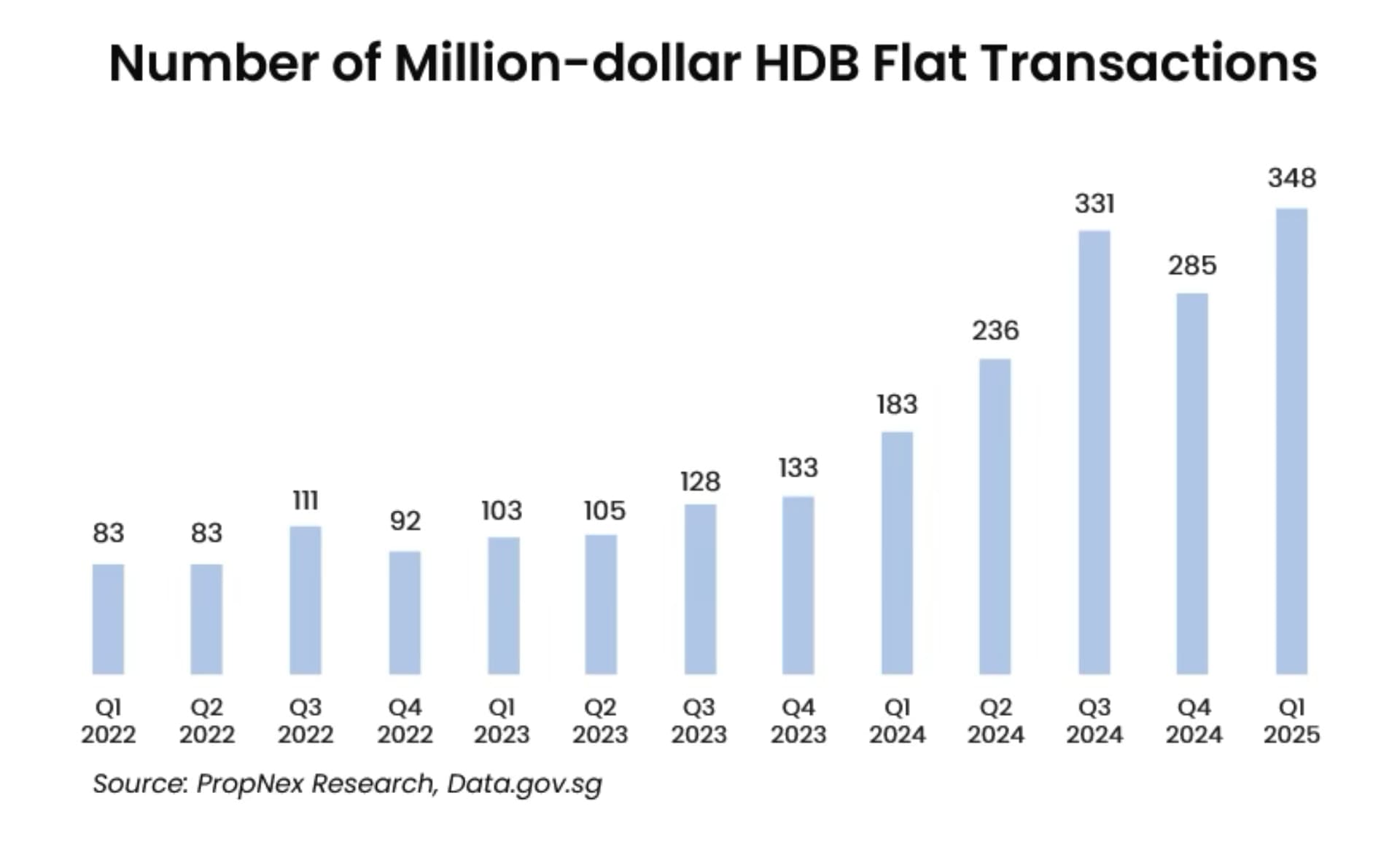

- 348 resale flats ≥$1M – a new quarterly high.

- Breakdown: 148 (4-room), 123 (5-room), 77 (executive).

- 22% increase from 285 units in Q4 2024.

- Represents 5.5% of total transactions.

- More 4-room million-dollar transactions, especially in newer MOP flats in Bidadari, Dawson, Toa Payoh, etc.

- 2025 on track to surpass 1,000 million-dollar flat transactions again (2024: 1,035).

Outlook

- Q1 2025 among weaker resale quarters in recent years.

- Buyers drawn to BTOs/SBFs with shorter wait times and ready-to-move-in options.

- PropNex expects resale demand to pick up in Q2–Q3, due to:

- BTO rejection fallback.

- PRs, families, and former private owners re-entering market after 15-month wait-out.

- Resale prices expected to rise by 5%–7% in 2025.

- Resale volume forecast: 28,000–29,000 units for 2025.

Disclaimer: While every reasonable care is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only. This information contained herein is not in any way intended to provide investment, regulatory or legal advice or recommendations to buy, sell or lease properties or any form of property investment. PropNex shall have no liability for any loss or expense whatsoever, relating to any decisions made by the audience.