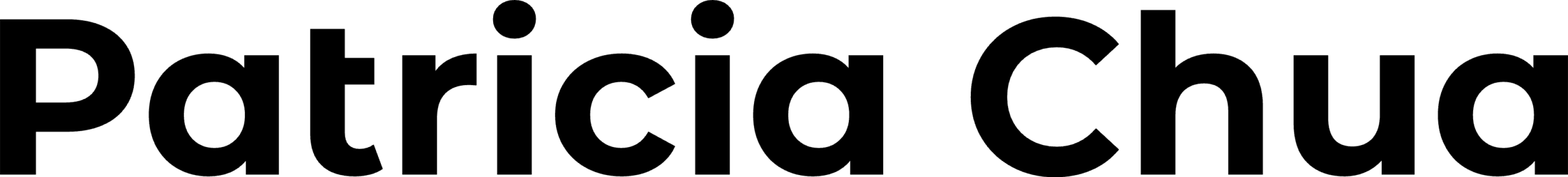

Singapore’s private home prices rose 0.6% QOQ in Q1 2025, moderating from the previous quarter’s 2.3% gain. The RCR led growth (+1.0%), while OCR demand slowed sharply. New sales held steady at 3,379 units, led by Parktown Residence, but resale and sub-sale volumes declined. With global economic headwinds emerging, developers may adopt cautious pricing, creating opportunities for buyers. Here’s a full analysis of Q1 trends and the outlook ahead.

Price Movement

- Private home prices rose by 0.6% QOQ in Q1 2025, down from 2.3% QOQ in Q4 2024. This marked the second consecutive quarter of increase.

- Landed and non-landed homes each grew by 0.6% QOQ.

- In the non-landed segment:

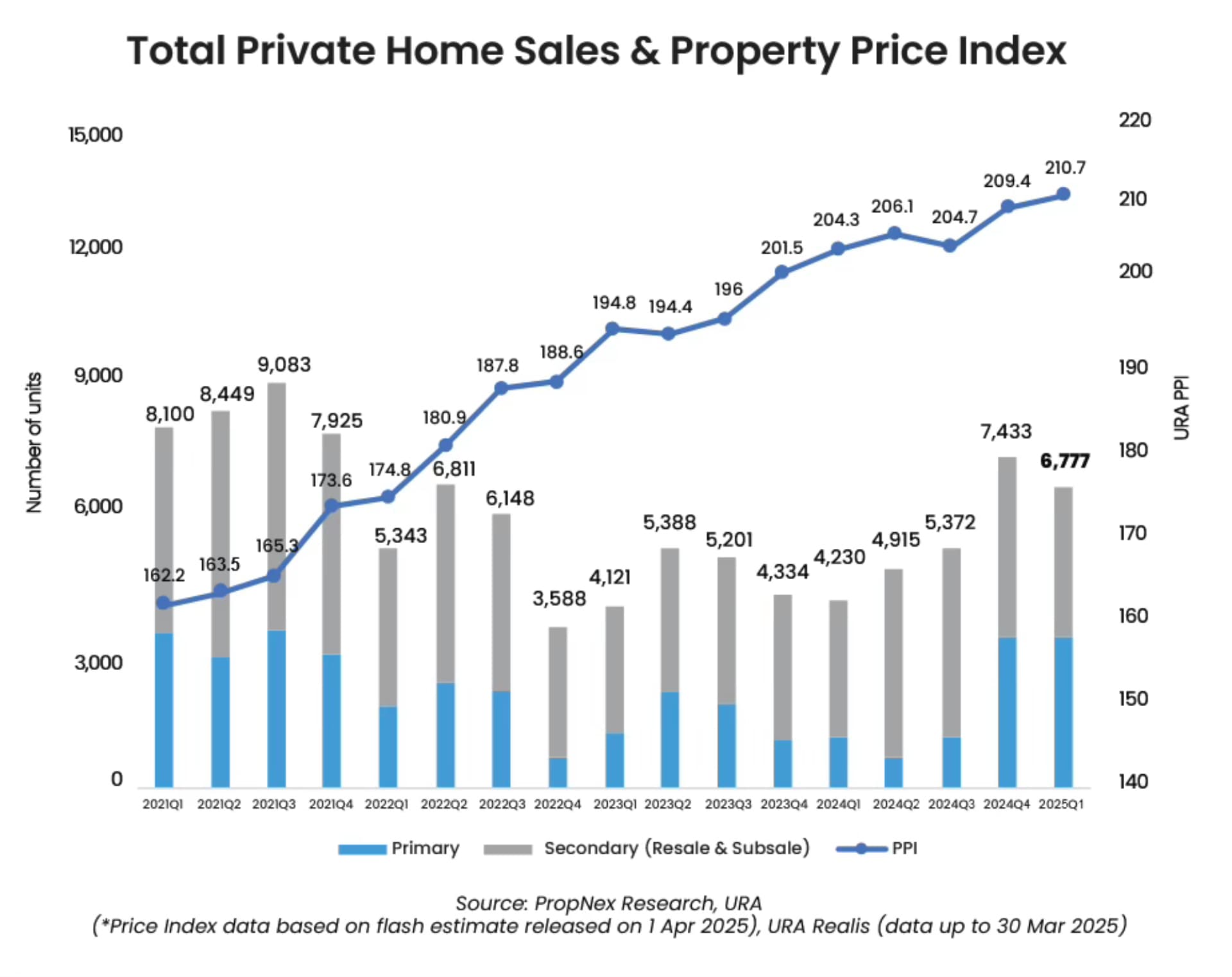

- RCR: +1.0% QOQ (The Orie was the key launch with 690 units sold at $2,732 psf)

- CCR: +0.6% QOQ

- OCR: +0.3% QOQ (significant slowdown from +3.3% in Q4 2024)

- Landed segment: First increase in three quarters (+0.6% QOQ)

- Detached: +19.2% QOQ to $1,910 psf

- Semi-detached: +1.3% QOQ

- Terrace: +1.9% QOQ

Transaction Volume

- Landed homes: 443 units (↓13% from Q4).

- New private home sales (excl. EC): Estimated 3,379 units sold, similar to Q4 2024

- Top-selling project: Parktown Residence (OCR) – 1,059 units at $2,370 psf

- OCR led sales, contributing 66% of total new sales (2,233 units)

- Highest OCR quarterly performance since Q2 2013

- Resale: 3,158 units (↓14.7% QOQ)

- Top resale: Treasure at Tampines (46 units at $1,729 psf)

- Sub-sales: 240 units (↓23% QOQ)

- Total private homes sold (primary + resale): 6,777 units

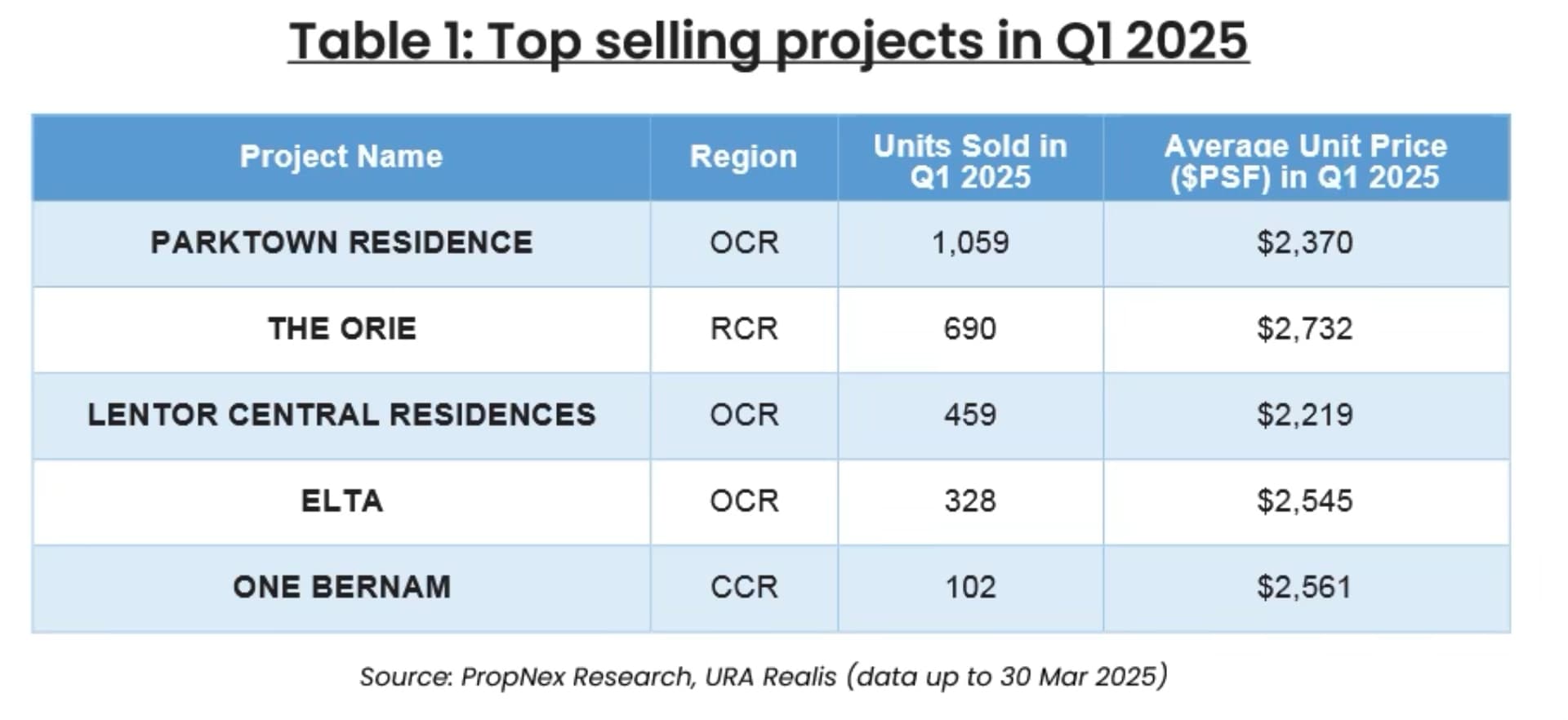

Rental Market

- Jan–Feb 2025: 13,316 leasing contracts (~$71M), up slightly from same period in 2024.

- Median rental: $4.94 psf/month, up from $4.90 in Q4 2024.

- Highest rent for landed: $95,000/month (Cluny Rd); Non-landed: $39,000/month (Goodwood Residence, Hana, One Chatsworth).

- URA reported 1.9% rental decline in 2024 (first yearly decline since 2020).

Market Outlook

- External headwinds emerged in April 2025: US tariffs + China retaliation, spooking global markets.

- PropNex expects:

- New home sales: 8,000–9,000 units (excl. EC)

- Private resale: 14,000–15,000 units for full-year 2025

- Price growth: 3%–4%.

- Developers to price sensitively; good buying opportunities expected.

- Upcoming Q2 2025 launches:

- One Marina Gardens (937 units)

- Bloomsbury Residences (358 units)

- Arina East Residences (107 units)

Disclaimer: While every reasonable care is taken to ensure the accuracy of information printed or presented here, no responsibility can be accepted for any loss or inconvenience caused by any error or omission. The ideas, suggestions, general principles, examples and other information presented here are for reference and educational purposes only. This information contained herein is not in any way intended to provide investment, regulatory or legal advice or recommendations to buy, sell or lease properties or any form of property investment. PropNex shall have no liability for any loss or expense whatsoever, relating to any decisions made by the audience.